Why This Is Worth Reading - Discover how the raw trust of friends, family, and bold risk-takers launches iconic brands into existence. Uncover fresh 2025 statistics revealing the enduring strength of personal networks in startup funding. Learn actionable steps to harness this primal force for your own venture, backed by real-world success stories.

In the crucible of creation, where dreams clash with reality, every entrepreneur faces a stark truth: ideas need fuel to burn bright. That fuel? Capital. But before venture capitalists or angel investors cast their calculating gaze, there’s a raw, unpolished source of funding that’s launched some of the world’s most iconic companies—friends, family, and fools (FFF). This type of financing isn’t just about money; it’s about trust, grit, and the audacity to bet on a vision when the world sees only risk.

From Google’s garage to Airbnb’s air mattresses, FFF funding has been the spark for global giants. In 2025, with startup ecosystems thriving yet fiercely competitive, understanding this primal force is more critical than ever.

The Raw Power of FFF Funding

FFF funding—friends, family, and those daring enough to back an unproven idea—remains a cornerstone of startup financing. In 2023, 35-40% of startups globally relied on FFF rounds to kickstart their ventures, a figure holding strong into 2025. Why? It’s fast, flexible, and built on belief, not metrics. Unlike venture capital, which demands traction and polished pitches, FFF investors often back the person, not the plan. This trust can be a lifeline, especially in the pre-seed stage, where 60% of startups fail to reach Series A.

Consider Google. In 1997, Larry Page and Sergey Brin raised $1 million from family and friends to build a search engine no one yet understood. That trust fueled a revolution. Or Airbnb, where founders Brian Chesky and Joe Gebbia leaned on personal savings and FFF funds to turn an air mattress rental into a $100 billion empire. These aren’t anomalies. WhatsApp, VICE, and even Facebook’s early days trace back to the same raw faith of personal networks.

I’ve walked this path myself, raising capital from friends, family, and bold early believers for my own ventures. Every one of those investors saw a strong rate of return—not by chance, but because I brought them in when the deal had real legs, with clear momentum and a path to success. Timing and transparency turned trust into triumph. Yet, FFF isn’t a fairy tale. It’s a double-edged sword. Mixing money with relationships can strain bonds, and 21% of startups cite mismanaged FFF expectations as a reason for early failure. The key? Treat it like a professional investment—clear terms, honest risks, and regular updates. Done right, FFF is a rocket booster for your vision.

Watch This to Level Up

Airbnb’s Founding Story - Brian Chesky shares how FFF and hustle turned a crazy idea into a global brand. See the raw grit behind their early days.

The Numbers Tell the Story

In 2025, the startup landscape is a battlefield. Global venture funding hit $66.5 billion in Q3 2024, but only 0.05% of startups secure VC capital. Meanwhile, FFF remains accessible, with 16% of small businesses in the U.S. citing it as a primary funding source. The average FFF round ranges from $50,000 to $200,000, enough to test a hypothesis, build a prototype, or gain early traction. For perspective, 50 million new startups launch annually, and 90% fail—many due to underfunding. FFF bridges that gap.

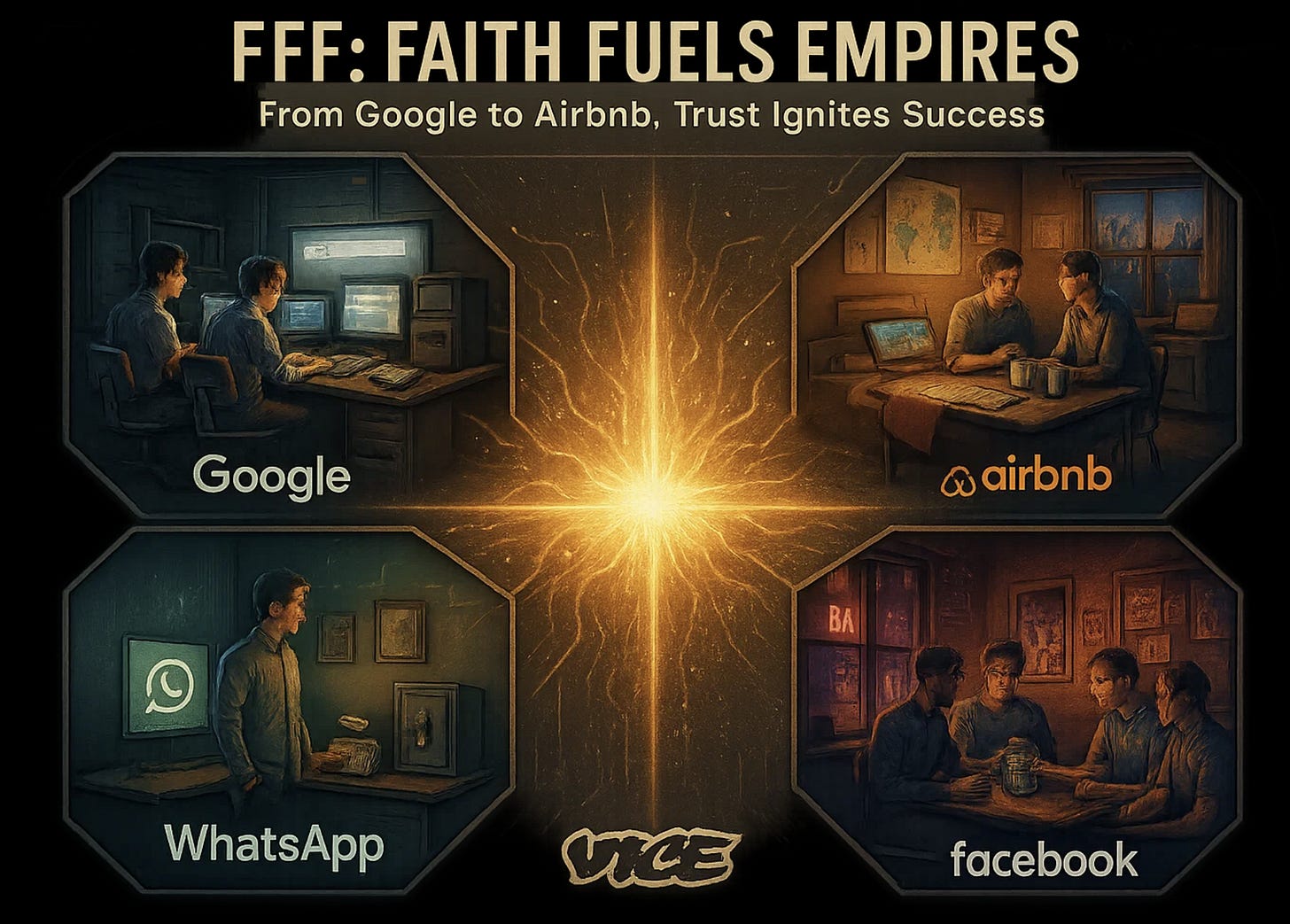

Here’s a visual breakdown of funding sources for startups in 2025:

This chart underscores FFF’s role as a critical, accessible option when VC doors are shut. But accessibility comes with responsibility. Unlike faceless institutional investors, FFF backers are your inner circle. Betray their trust, and you risk more than money.

Icons Born from Trust

The stories of FFF-funded giants are legends of conviction. Take VICE, which borrowed a few thousand dollars from relatives to launch a gritty magazine that became a $5 billion media empire. Or WhatsApp, where Jan Koum and Brian Acton’s family-backed early days led to a $19 billion acquisition. These founders didn’t just raise money; they harnessed belief to defy odds.

Even in 2025, FFF fuels innovation. Allbirds, the sustainable footwear darling, raised $120,000 via crowdfunding and FFF in 2014, scaling to a $1.4 billion valuation. Peloton’s 2013 Kickstarter, backed by friends and early believers, raised $400,000 to disrupt fitness, hitting a $50 billion peak during the pandemic. These brands prove FFF isn’t just startup kindling—it’s a forge for enduring success. My own success with FFF reinforces this: by waiting until my venture had traction and a clear roadmap, I ensured my backers weren’t just betting on hope—they were investing in a winner.

Watch This to Level Up

How to Raise Money from Friends and Family: A no-nonsense guide to structuring FFF deals with clarity and professionalism. Learn how to pitch with confidence and protect relationships.

The Risks and How to Master Them

FFF funding is potent but perilous. Relationships can fray when expectations aren’t met. In a 2024 survey, 30% of founders reported strained personal ties after FFF rounds went south. The “fools” moniker isn’t just playful—some backers may not grasp the 90% startup failure rate. Your job? Be a warrior of clarity.

Set Ironclad Terms: Use simple contracts or IOUs. Specify if it’s a loan, equity, or gift. Transparency is your shield.

Communicate Relentlessly: Share quarterly updates—wins, setbacks, and next steps. Silence breeds mistrust.

Know the Stakes: Warn backers they could lose everything. As Sarp Sekeroglu, CEO of Water Pigeon, puts it, “The downside is zero dollars. Don’t invest what you can’t lose.”

Time It Right: Like I did, bring FFF investors in when your venture has traction—early customers, a working prototype, or clear market demand. This isn’t about blind faith; it’s about giving them a real shot at success.

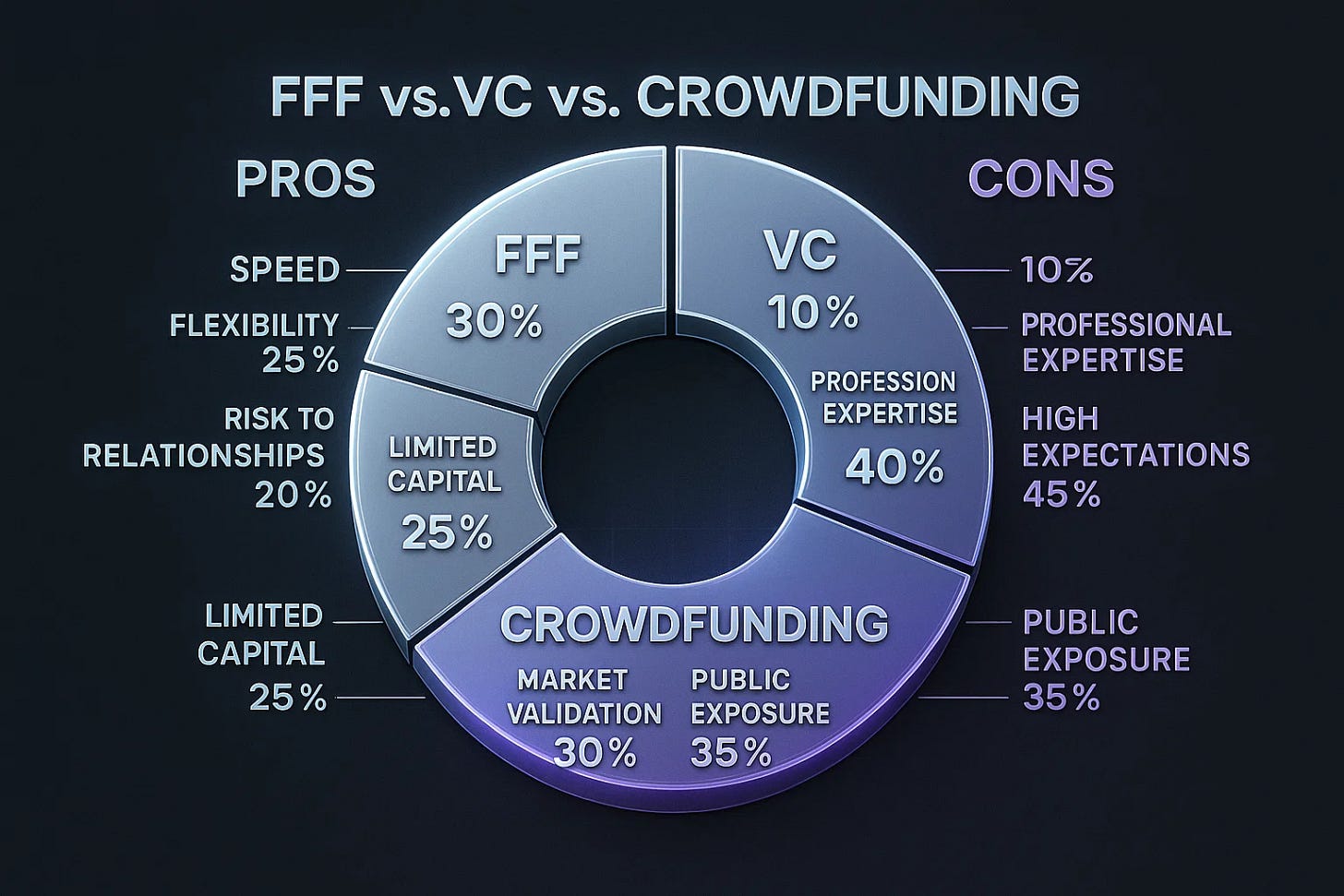

Here’s how FFF compares to other funding options in 2025:

This graph highlights FFF’s edge in speed and flexibility but warns of its relational risks. Master these, and you wield a powerful tool.

Watch This to Level Up

Managing Investor Relationships - Tips on keeping FFF backers informed without losing your sanity. Build trust through consistent communication.

The Path Forward: Your Call to Action

You stand at a crossroads. The world doesn’t owe you success—it demands you seize it. FFF funding isn’t just cash; it’s a pact of trust with those who believe in you. Harness it with purpose, and you can ignite your vision like Google, Airbnb, or Peloton. Ignore its power, and you risk stalling before the race begins. My own journey proves what’s possible: with a solid foundation and strategic timing, FFF can deliver not just capital but life-changing returns for everyone involved.

Forge Your FFF Strategy in 5 Steps

Identify Your Circle: List 10-20 people who trust you deeply—friends, family, or bold supporters. Don’t pitch yet; just know who’s in your corner.

Craft a Clear Ask: Define how much you need ($50K? $200K?) and what it’s for (prototype, marketing, hires). Be precise. Vague plans scare backers.

Armor Up with Agreements: Draft a simple contract or IOU. Use online templates or consult a lawyer for $500-$1,000. Clarity prevents chaos.

Lead with Truth: Meet each backer face-to-face or via video. Explain the 90% failure risk and your relentless commitment. Honesty builds trust.

Commit to Updates: Schedule quarterly emails or calls to share progress. Even bad news, delivered with grit, strengthens bonds.

The arena of entrepreneurship is unforgiving, but FFF gives you a fighting chance. Step into it with courage, treat your backers like allies, and build something that echoes beyond your lifetime. Start today—your empire awaits.